It’s that time of year when our thoughts turn to Hallowe’en, mid-term break, darker evenings, and longer nights in front of the fire. It’s also the time of year that many self-employed people turn their thoughts to their pension as the tax deadline is looming.

Using your pension to buy property.

While you can benefit from generous tax reliefs by contributing to your pension, individuals considering whether to invest in the property market might consider using their pension funds to purchase property.

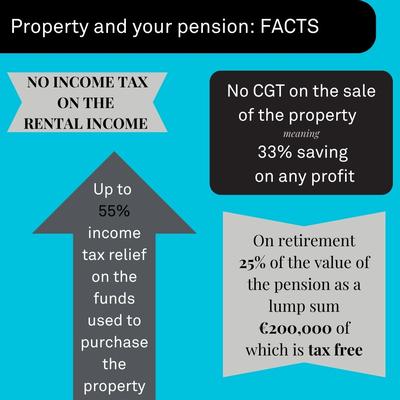

One of the main benefits of using a pension fund to purchase property is that you can use monies which have not been subject to income tax to purchase the property. Property purchased outside a pension fund is purchased from post income tax proceeds, or else purchased using borrowings that must be repaid using post tax income.

Given the current marginal rates of tax, up to a maximum of 55%, significant savings can be made by using your pension fund to invest in property rather than investing through after- tax income

In addition, no income tax is payable on the rental income earned within your pension fund. When you choose to sell the property, no Capital Gains Tax (CGT) is payable on the proceeds of the sale. It is not compulsory to sell the property on retirement.

Reasons to invest pension in property

- You can choose the property you wish to purchase with your pension which gives you control over your pension - residential, commercial, and industrial or a combination of each can be held with the fund.

- Income tax relief on contributions made to fund the purchase are at the higher rate of tax.

- There is no income tax on the rental income and no Capital Gains Tax (CGT) on the eventual sale of the property.

- Upon retirement, you can take 25% of the value of the pension fund as a lump sum, of which €200,000 is tax free. The property can transfer in specie to a self-administered ARF and the rental income can contribute to your income in retirement (draw-downs are subject to PAYE).

- In certain cases, borrowings can be used to assist in purchasing the property.

- By including property in your pension, you are diversifying your portfolio and spreading your risk across another different asset class and in a different manner.

- There is potential for long-term capital appreciation. Property values, over time, tend to increase and this could provide an additional nest egg upon retirement.

There are of course some restrictions on investors in terms of property investment. These include that you cannot use the property personally, it must be for investment only. When you do sell the property, it cannot be to relatives, your employer, or directors of associated companies.

Planning your retirement and managing your pension can be a complex task. Before undertaking any investments, you should speak with a Qualified Financial Adviser. They will be able to explain the choices available to you and help you understand your risk profile. Then if you are thinking of purchasing a property within your pension, just get in touch and we can help you secure the right property for your needs.